Heartwarming Info About How To Lower Finance Charges

For that, you need to pay your outstanding credit balance in full before the due.

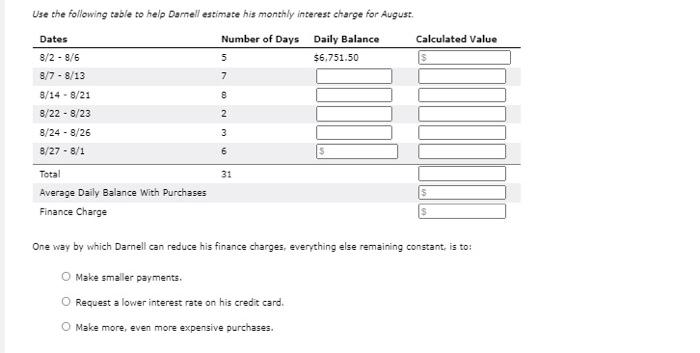

How to lower finance charges. For credit cards, payment of the entire balance during the grace period each month prevents the accumulation of finance charges. Clearing your card balance 1. Refinance debt to get a lower interest rate pay off debt so that you don’t pay any interest at all

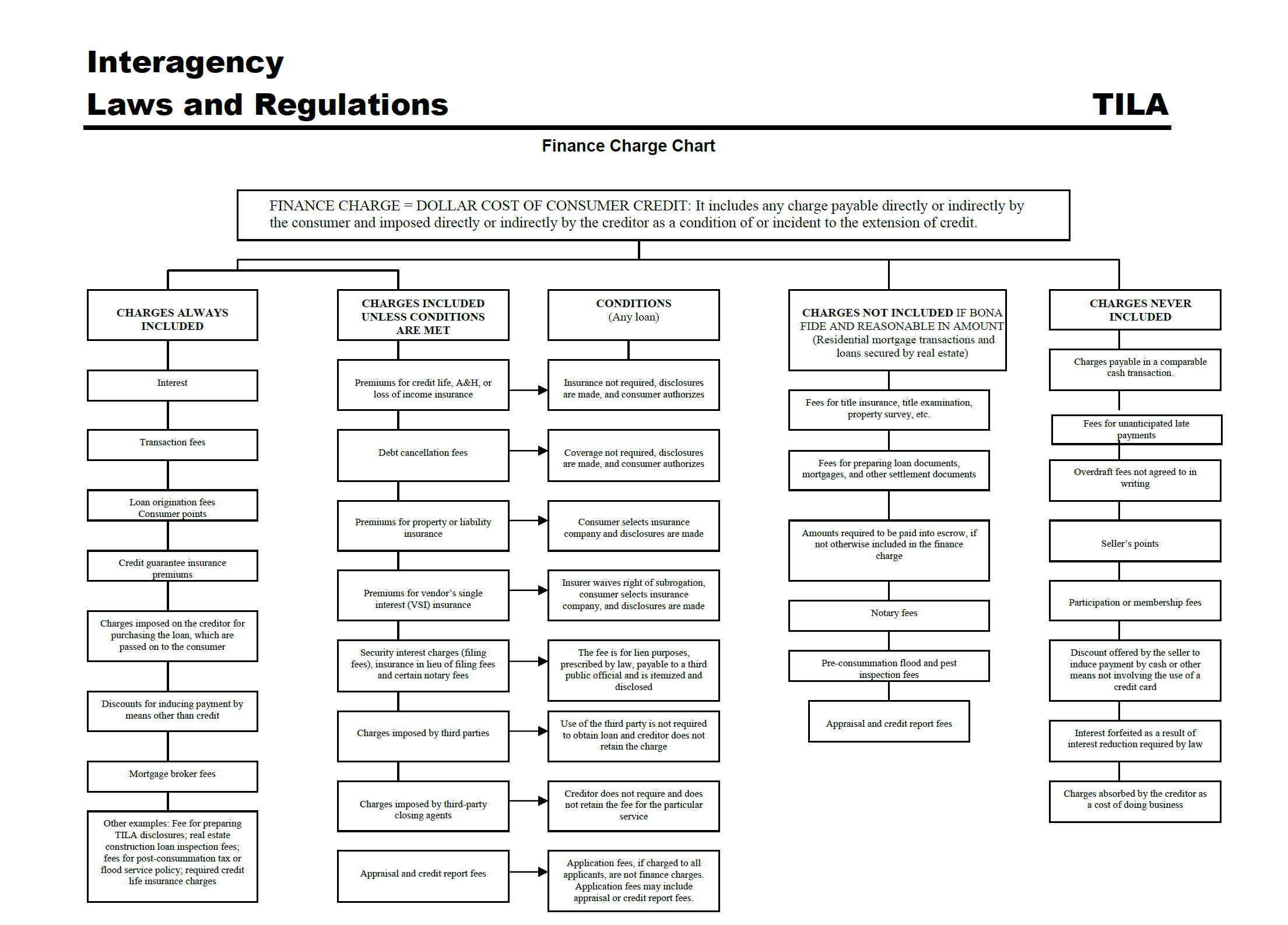

Thus, a stable business with predictable cash flows and a conservative financial. Getting out from under those extra fees can. Since finance charges are the credit card issuer's way of charging you for carrying a balance, the simple way to avoid finance charges is to pay your full balance each month.

By making prepayments on a loan you reduce how. Secured credit card companies typically charge high annual fees and an even higher interest rate on top of requiring you to pay a security deposit. The simplest way to reduce the finance charge is to avoid accruing interest on your balance.

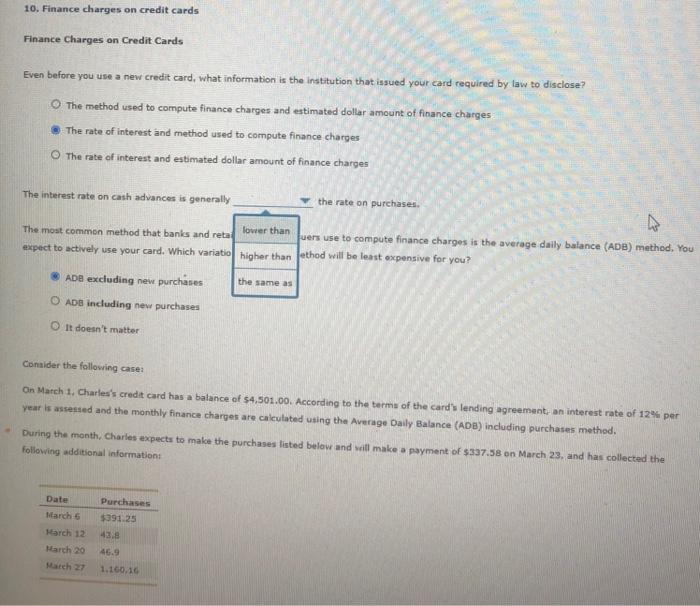

The amount of finance charges is closely related to the creditworthiness of the borrower. If you have $100 in a savings account at 3% interest, you will earn a little over $3 in one year. There are essentially two approaches:

This assumes that you keep the loan through the full. If you can swing it, pay twice as much as the monthly minimum. A finance charge is the total amount of interest and loan charges you would pay over the entire life of the mortgage loan.

Pay off your balance at the end of every billing cycle. 3) contact a debt counselor. Additionally, any amount you pay over your scheduled payment amount and.

/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

/30386607081_620e3d475e_k-27d2c3542c9e4419a8697b09082b15d0.jpg)