Breathtaking Tips About How To Buy Tax Deeds

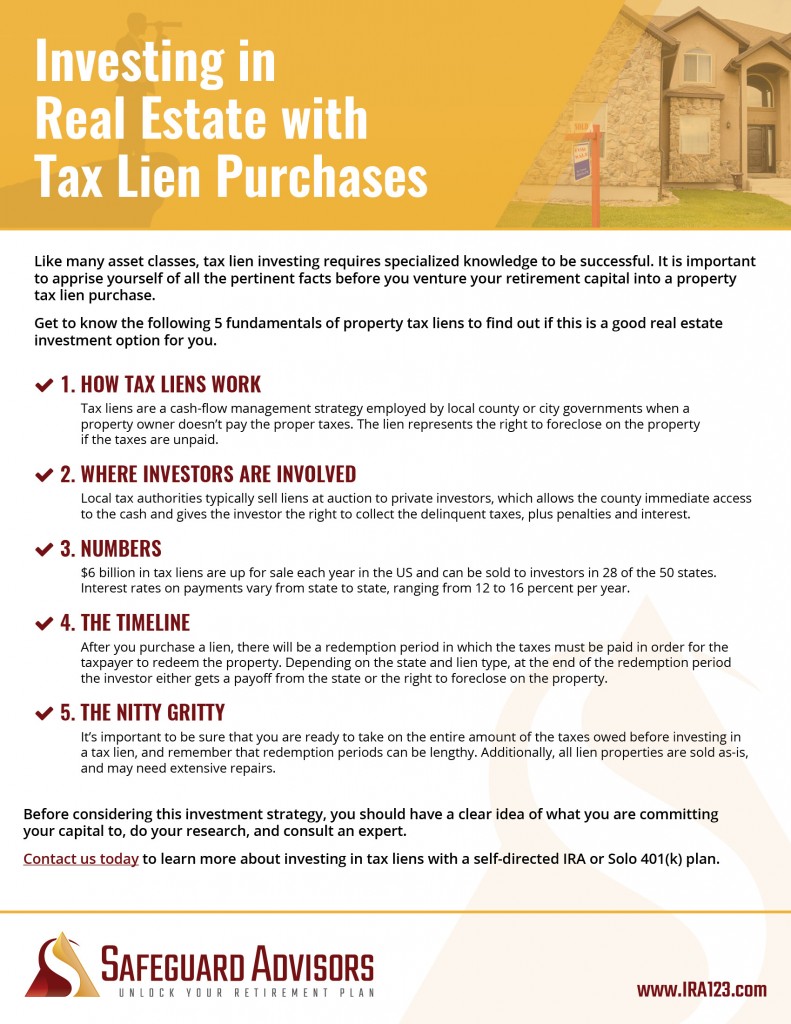

The procedure involves a tax certificate holder (tax certificates are sold to collect delinquent taxes) applying for a tax deed through the tax.

How to buy tax deeds. Some states have the former and some have the latter. How do you buy property tax deeds? Your remittance must be postmarked no later than the 10th calendar day.

The first step to buying a tax deed. County websites also often have a list of pending tax deed sales or an. Counties across the country handle these.

Tax deed investors buy these tax deeds at auctions. If the state has held a tax. You are given 10 calendar days from the date on the price quote to remit your payment.

A tax lien sale is a method many states use to force an owner to pay unpaid taxes. How to buy tax deeds in florida? The florida statutes governing tax deed.

If you don't like buying in auctions, then this is perfect for you! If the property is not redeemed within the (3) three year redemption period the purchaser of the alabama tax lien certificate can apply for a tax deed to the property. The first step to investing in a tax deed property is to find tax deed sales in their counties.

Some states have “hybrid” systems in. Buying a tax deed in georgia. The taxing authority—usually a county government—must go through a series of legal steps in order to acquire a tax deed.